Taxes

Broken Arrow companies are benefitting from Oklahoma having one of the lowest business tax burdens in the US. The state offers companies a low cost of doing business, a low cost of living for employees, and tax rebates that reduce tax burdens even further.

State of Oklahoma Tax Guide

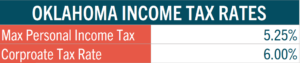

Income Tax

Sales Tax

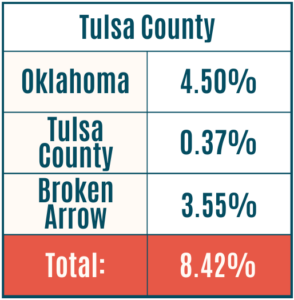

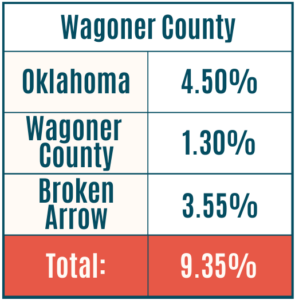

Cities and towns in Oklahoma derive their funding primarily from sales and use tax, permit fees, service fees, grants, and fines. The City of Broken Arrow’s city limits falls in both Wagoner and Tulsa counties.

Property Tax

For businesses, property taxes are based on the assessed value of the tangible property: furniture, fixtures, equipment and inventory that is owned on January 1 of the current tax year. In Oklahoma, property taxes are the main source of non-grant revenue for school districts, counties, and career-tech systems.

Property Tax Exemption for Manufacturing

Certain new or expanding manufacturing or research and development facilities may qualify for a five-year exemption from property taxes when adding investment or jobs. Some business inventories may be exempted from property taxation in whole or in part if not detained in Oklahoma for more than nine months.

Learn more

Tax Increment Financing District (TIF)

The City of Broken Arrow partners with Tulsa and Wagoner Counties to utilize TIF Districts, state-authorized public funding tools designed to capture incremental taxes within a specified area and then dedicate such funds to a specific use, such as infrastructure improvements and assistance in development financing. This tool has been utilized to gain private investment of an estimate $50 M for the creation of the award-winning Rose District (link to info about the district), retain more have 650 jobs at Broken Arrow facility of aerospace leader Flight Safety International and recently the creation of the 90-acre industrial park Creek 51.

Other Taxes

The City of Broken Arrow collects a 2% franchise tax on utilities unless otherwise negotiated, a 4% hotel tax, 3.55 % use tax and state-shared revenues taxed on telephones, alcoholic beverages, tobacco, and gasoline.